What is a unit trust fund dividend or distribution?

Throughout the year, unit trust fund managers buy and sell securities for the fund's portfolio, generating investment gains and losses. Unit trust funds distribute net gains arising from sales of appreciated securities and from accumulated stock dividends and bond interest payments, net of expenses. By default, your distributions are reinvested in shares of the fund. You also have the option to take the distributions in cash.

You can find information about your fund's dividend and distribution schedule in the fund's prospectus. Saturna publishes the dividend and distribution history for each of our affiliated funds here at Saturna.com.my.

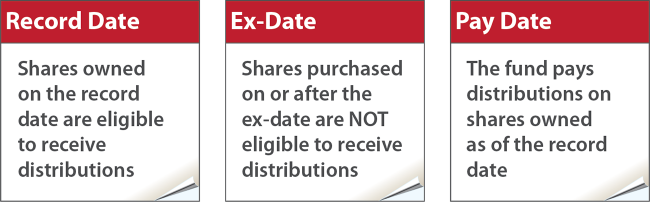

What's the difference between record date, ex-date, and pay date?

The record date determines your eligibility to receive fund distributions. If you own shares on the record date, you are a shareowner of record, and you will receive a distribution on each share you own as of that date. The ex-date (or ex-dividend date) indicates the first date that shares are not eligible for the distribution. Fund shares purchased on or after the ex-date will not receive the distribution declared on the record date. The pay date (also, payable date, payment date) is the date the mutual fund makes distributions on shares you owned as of the record date. For Saturna's affiliated funds, the ex-date and the pay date are generally the same.

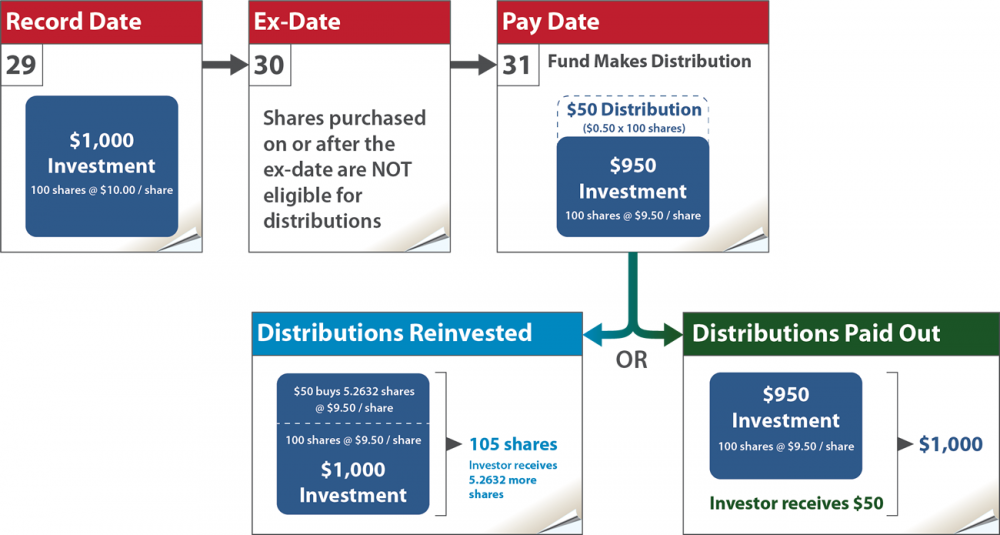

How do fund distributions affect my investment?

When a unit trust fund makes a distribution of capital gains or pays a dividend, its net asset value (NAV) is reduced by an amount equal to the distribution, so you may see a drop in share value. However, this doesn't mean that you are losing money. If you reinvest the distributions, you will own more shares to make up the difference. If you elect to have your distributions paid out, you'll receive the value in cash. Keep in mind that, due to market fluctuations, the fund's share value may increase or decrease after a distribution.

Assuming a constant market value, the following example helps explain how distributions can affect your investment.