Relics of the Past? Disruptive Innovation in the Telecom Industry

Download a PDF:

Water, water, every where,

Nor any drop to drink.

The Rime of the Ancient Mariner

S. T. Coleridge

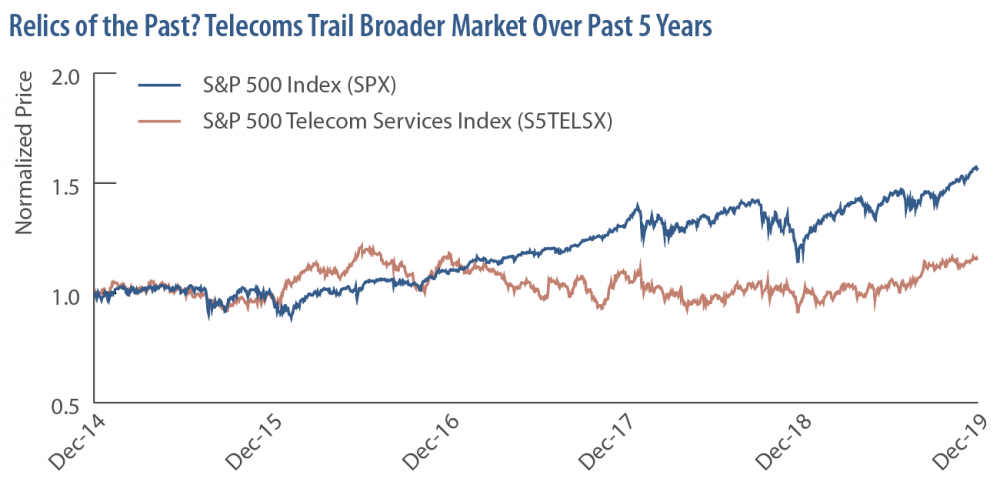

The telecom industry has seen tremendous worldwide growth in recent years as consumers stream more content on their mobile phones, connect to myriad devices, and use an increasing number of applications and services. In 2010, there were 285 million wireless subscribers in the United States. That number grew to 400 million in 2017,1 an annual growth rate of nearly 5%. Data traffic during that period increased almost a hundredfold to 30 trillion megabytes.2 However, despite meaningful subscriber and data growth, US telecom industry revenue only grew from roughly $160 billion to around $179 billion during that period, a compound annual growth rate of 1.5%.3 Average revenue per user fell from around $50 a month to $39 a month.4 Similar trends hold globally, with traffic up exponentially and subscribers growing at a healthy clip, but industry revenues and profitability languishing. Unsurprisingly, those investing in the telecom sector have not fared as well as other investors, with the S&P Telecom Services Index providing a return of 15.80% over the past five years compared with a 56.92% total return for the S&P 500 Index.5

As investors wonder why the industry has been unable to monetize substantial subscriber and data growth, and why the sector has routinely underperformed, we believe several factors explain the disconnect. First, competition continues to intensify across the globe, forcing telecom companies to reduce plan prices, while providing greater amounts of data and related services. For example, T-Mobile took considerable US market share6 in recent years by offering unlimited data plans at affordable prices. In India, Reliance Jio, owned by billionaire Mukesh Ambani and financed in-part by cash flow from his petrochemical businesses, increased its market share by 20% in less than two years, thanks to monthly plans as low as $3.7 A similar trend transpired in Italy when French telecom Illiad successfully entered the Italian market through aggressive price cutting. Naturally, lower plan prices generally translate into lower revenues and profitability for the operators, and, by extension, muted share price performance.

US TELECOM INDUSTRY

REVENUE GREW AT A

LOW 1.5% CAGR OVER

LAST FIVE YEARS.

Regulators have also played a crucial role in shaping the industry's direction. In China, for instance, the government regulates the tariffs telecom operators can charge consumers to keep mobile services affordable for the masses. In the Philippines and Singapore, new telecom licenses are being issued to breed more competition. Issuance of additional wireless spectrum is yet another lever governments have at their disposal to nurture or curtail industry growth. Telecom operators need spectrum for better network quality, speed, and reliability, and often spend exorbitant amounts on spectrum acquisitions. A case in point, a recent spectrum auction in Thailand went through nearly 200 rounds of bidding and lasted for 66 hours, with the winners paying a record price of $4.2 billion.8 In addition to spectrum-related spending, telecom companies need to constantly undertake network upgrades to modernize their infrastructure and technology (from third-generation, or 3G, to 4G and, soon, to 5G) to remain competitive and relevant.

Investors have to be vigilant about constant change befalling the telecom industry. In recent years, over-the-top (OTT) providers like Facebook, Skype, and WeChat – which distribute media content directly to consumers through the Internet – have disrupted the traditional telecom landscape by offering free messaging, voice, video, and other services. The number of active monthly worldwide users of the Facebook-owned mobile messaging app WhatsApp grew from 250 million in June 2013 to 1.5 billion by the end of 2017.9 Predictably, voice and SMS revenues have declined significantly for the incumbent operators across the globe.10 In a recent Ernst & Young survey, when asked to name the top strategic challenges facing the telecom industry, three-fourths of survey participants underscored disruptive competition.11 Other trends redefining the industry include the rising use of streaming services, voice-assisted technologies (e.g., Amazon Alexa or Apple Siri), the Internet-of-Things (IoT, e.g., connected homes, cars, and devices), big data, augmented/virtual reality (AR/VR), and artificial intelligence. A 2019 Deloitte study highlighted that 69% of US households now subscribe to paid video streaming services, with pay-TV penetration shrinking to 65%.12 Deloitte also noted that penetration of voice-assisted speakers across homes saw a 140% increase from 2017 to 2018, rising to 36%.13

It is natural for investors to ask what is next for the industry. Currently, most service providers are focused on the development of next-generation 5G technology, already being rolled out commercially in select cities like Chicago, Seoul, Sydney, and London.14 5G is expected to deliver speeds up to 100x faster than the current 4G technologies (10 gigabytes/second vs. 100 megabytes/second), improve network quality (fewer dropped calls and better connections), and enable widespread use of the trends discussed above. With 5G, IoT applications will be able to collect, analyze, and interpret vast amounts of data from millions of devices and sensors, enabling more optimal monitoring and management of hospitals, police departments, homes, warehouses, and cars, among others. Likewise, with AR/VR applications, consumers will be able to survey a potential new home they are looking to purchase in New York from their living room in Shanghai, or watch and comment on a live, immersive Real Madrid game with a friend in São Paolo.

OVER-THE-TOP

PROVIDERS LIKE

NETFLIX AND FACEBOOK

HAVE DISRUPTED THE

TRADITIONAL TELECOM

LANDSCAPE.

Going forward, telecom companies need to formulate strategies on how to best exploit these emerging trends and determine which investments could potentially deliver higher profitability and investor returns in the future. At the risk of stating the obvious, it is imperative that telecom companies devise business models that monetize the benefits of 5G and other investments. Telecom operators can’t simply let the likes of Netflix, Alphabet, and others become industry titans on the back of infrastructure that they developed so diligently over the years; they need ways to tap into and leverage this infrastructure for themselves. Service providers also need to differentiate via specific, innovative product offerings to attract and retain customers.

TELECOMS MUST

ADOPT AN APPROACH

THAT IS NIMBLE AND

RECEPTIVE TO CHANGE

OR RISK BECOMINGT

RELICS OF THE PAST.

To be successful, a telecom company may decide to develop its own media content, or at the very least, partner with a content provider to offer intriguing content. AT&T recently purchased Time Warner to gain access to valuable entertainment properties like TNT, TBS, HBO, and Warner Bros. Pictures, which owns the rights to DC Comics characters and has produced many successful movies including Aquaman, Wonder Woman, and Justice League. In Spain, Telefónica and Netflix have inked a global partnership that allows customers to watch the popular streaming service through Telefónica’s content platform.

Likewise, another telecom operator may opt to become a "smart home" facilitator, enabling customers to pay their utility bills, replenish their groceries via a voice-assisted device, or remotely monitor their children at home from work. Some telecom companies are beginning to venture out into mobile banking and related services. Notably, France’s leading telecom operator Orange recently launched Orange Bank, which provides mobile banking services including payments, virtual advice, and account management. Orange leverages its telecom branch network to cross-sell banking services and has added roughly 250,000 banking customers in the first two years of operations.15 Whatever business models the operators decide to adopt, they can't afford to be lax or merely reactive; they must embrace a proactive approach that is nimble and receptive to change. If they don’t, they will become relics of the past, like WorldCom, Global Crossing, Reliance Communications, Oi Brazil, and many others.

Footnotes

1 Number of Mobile Cellular Subscriptions in the United States from 2000 to 2018 (in millions), Statista, 2019. https://www.statista.com/statistics/186122/number-of-mobile-cellular-subscriptions-in-the-united-states-since-2000/

2 Volume of the Wireless Data Traffic in the United States from 2010 to 2018 (in million gigabytes), Statista, 2019. https://www.statista.com/statistics/615419/wireless-data-traffic-in-the-us/

3 Total Service Revenues of the Mobile Wireless Industry in the United States from 1985 to 2018 (in billion U.S. dollars), Statista, 2019. https://www.statista.com/statistics/185802/mobile-wirless-service-revenues-in-the-united-states-since-1985/

4 Communications Marketplace Report, FCC Fact Sheet, November 21, 2018. https://docs.fcc.gov/public/attachments/DOC-355217A1.pdf

5 Bloomberg S5TELSX vs. SPX for 5-year period as of December 31, 2019.

6 Wireless Subscriptions Market Share by Carrier in the U.S. from 1st Quarter 2011 to 3rd Quarter 2019, Statista, 2019. https://www.statista.com/statistics/199359/market-share-of-wireless-carriers-in-the-us-by-subscriptions/

7 Parbat, Kalyan. Reliance Jio Third-largest Telecom by Revenue Market Share, The Economic Times, June 12, 2018. https://economictimes.indiatimes.com/industry/telecom/telecom-news/reliance-jio-third-largest-telcom-by-revenue-market-share/articleshow/64550327.cms

8 Waring, Joseph. Thailand’s True, Jasmine win 4G Licenses for Record $4.2B, Mobile World Live, December 21, 2015. https://www.mobileworldlive.com/featured-content/home-banner/thailands-true-jasmine-win-4g-licences-for-record-4-2b/

9 Number of Monthly Active WhatsApp Users Worldwide from April 2013 to Deccember 2017 (in millions), Statista, 2019. https://www.statista.com/statistics/260819/number-of-monthly-active-whatsapp-users/

10 AT&T’s Revenue from its Business Wireline Segment from 2017 to 2019 (in million U.S. dollars), Statista, 2019. https://www.statista.com/statistics/216663/total-revenue-of-atundt-by-business-segment/

11 Digital Transformation for 2020 and Beyond: A Global Telecommunications Study, EY, 2017. https://www.ey.com/Publication/vwLUAssets/ey-digital-transformation-for-2020-and-beyond/%24FILE/ey-digital-transformation-for-2020-and-beyond.pdf

12 Downs, K., Loucks, J., Watson, J., and Westcott, K. Digital Media Trends Survey, 13th Edition, Deloitte Insights, March 19, 2019. https://www2.deloitte.com/insights/us/en/industry/technology/digital-media-trends-consumption-habits-survey.html

13 Ciampa, D., Littman, D., Loucks, J., Srivastava, S., Westcott, K., and Wilson, P. Build It and They Will Embrace It, Deloitte Insights. https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/global-mobile-consumer-survey-us-edition.html

14 Asay, Nikki. Ookla’s New 5G Map Tracks 5G Rollouts Across the Globe, Speedtest, May 14, 2019. https://www.speedtest.net/insights/blog/ookla-global-5g-map/

15 Davies, Jamie. Orange Bank is on a Roll, Telecoms.com, February 27, 2019. http://telecoms.com/495886/orange-bank-is-on-a-roll/

Important Disclaimers and Disclosures

This material is for general information only and is not a research report or commentary on any investment products offered by Saturna Capital. This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. To the extent that it includes references to securities, those references do not constitute a recommendation to buy, sell or hold such security, and the information may not be current. Accounts managed by Saturna Capital may or may not hold the securities discussed in this material.

We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. Investors should not assume that investments in the securities and/or sectors described were or will be profitable. This document is prepared based on information Saturna Capital deems reliable; however, Saturna Capital does not warrant the accuracy or completeness of the information. Investors should consult with a financial adviser prior to making an investment decision. The views and information discussed in this commentary are at a specific point in time, are subject to change, and may not reflect the views of the firm as a whole.

All material presented in this publication, unless specifically indicated otherwise, is under copyright to Saturna. No part of this publication may be altered in any way, copied, or distributed without the prior express written permission of Saturna.

A Few Words About Risk

Investment share prices, yields, and total returns will change with market fluctuations as well as the fortunes of the countries, industries, and companies in which it invests. Foreign investing involves risks not normally associated with investing solely in US securities. These include fluctuations in currency exchange rates, less public information about securities, less governmental market supervision and the lack of uniform financial, social, and political standards. Foreign investing heightens the risk of confiscatory taxation, seizure or nationalization of assets, establishment of currency controls, or adverse political or social developments that affect investments.

While diversification does not guarantee against a loss in a declining market, it can help minimize the risk of the decline of a single market.

About the Authors

Zahid Siddique MBA

Senior Equity Analyst